Are you already passing on the processing fees or doing it yourself?

Discover how we can help you save money and stay compliant

Your own dedicated Rep

Surcharge and Cash Discount rules are dynamic to say the least. With your dedicated rep you can operate your day to day business and we'll keep you up to date.

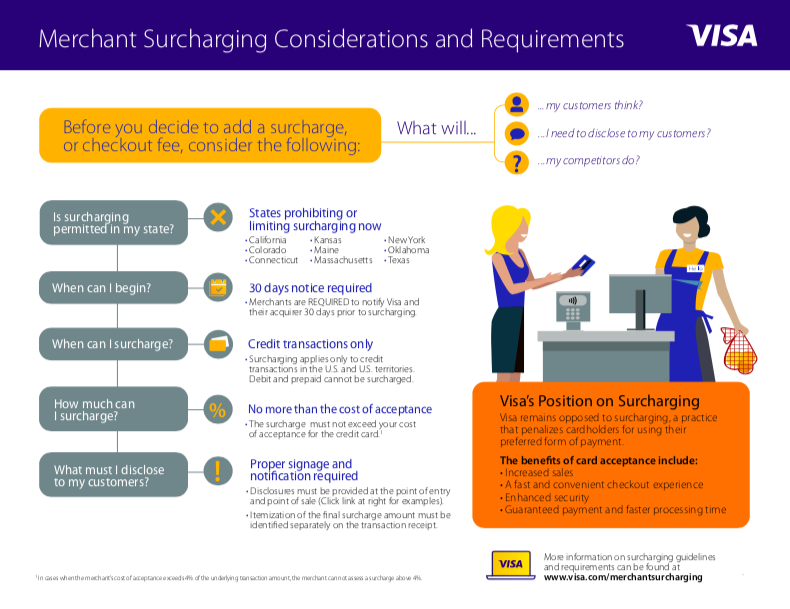

Surcharge Guidelines – What You Need to Know

With Surcharge you are adding a fee to the transaction and there are specific rules on how you do that.

What is Cash Discount

Also known as Duel Pricing, Cash Discount is priced like the gas stations and has specific rules you must follow.

What if I am not compliant?

Generally speaking customers reach out to Visa and report that you are passing on a fee within 90 days and Visa investigates to make sure you are compliant.

Your own dedicated Rep

In today’s rapidly evolving regulatory environment, having a dedicated representative to monitor surcharge and cash discount compliance is more than just a luxury—it’s a necessity. Rules and enforcement can vary by state, card brand, and even individual processors, making it easy to fall out of compliance without even knowing it. With a dedicated rep by your side, you gain a knowledgeable partner who stays ahead of industry changes, ensures your program is always compliant, and proactively addresses issues before they become costly problems. It’s peace of mind, expert guidance, and ongoing support—all tailored to protect your business and your bottom line.

Surcharge Guidelines – What You Need to Know

A surcharge is an additional fee added to credit card transactions, and it’s subject to very specific rules and regulations.

-

Surcharges are restricted or prohibited in certain states.

-

You cannot apply a surcharge to debit card transactions—these must be automatically identified by your system, not selected manually.

-

The surcharge amount is capped at 3% of the transaction total.

-

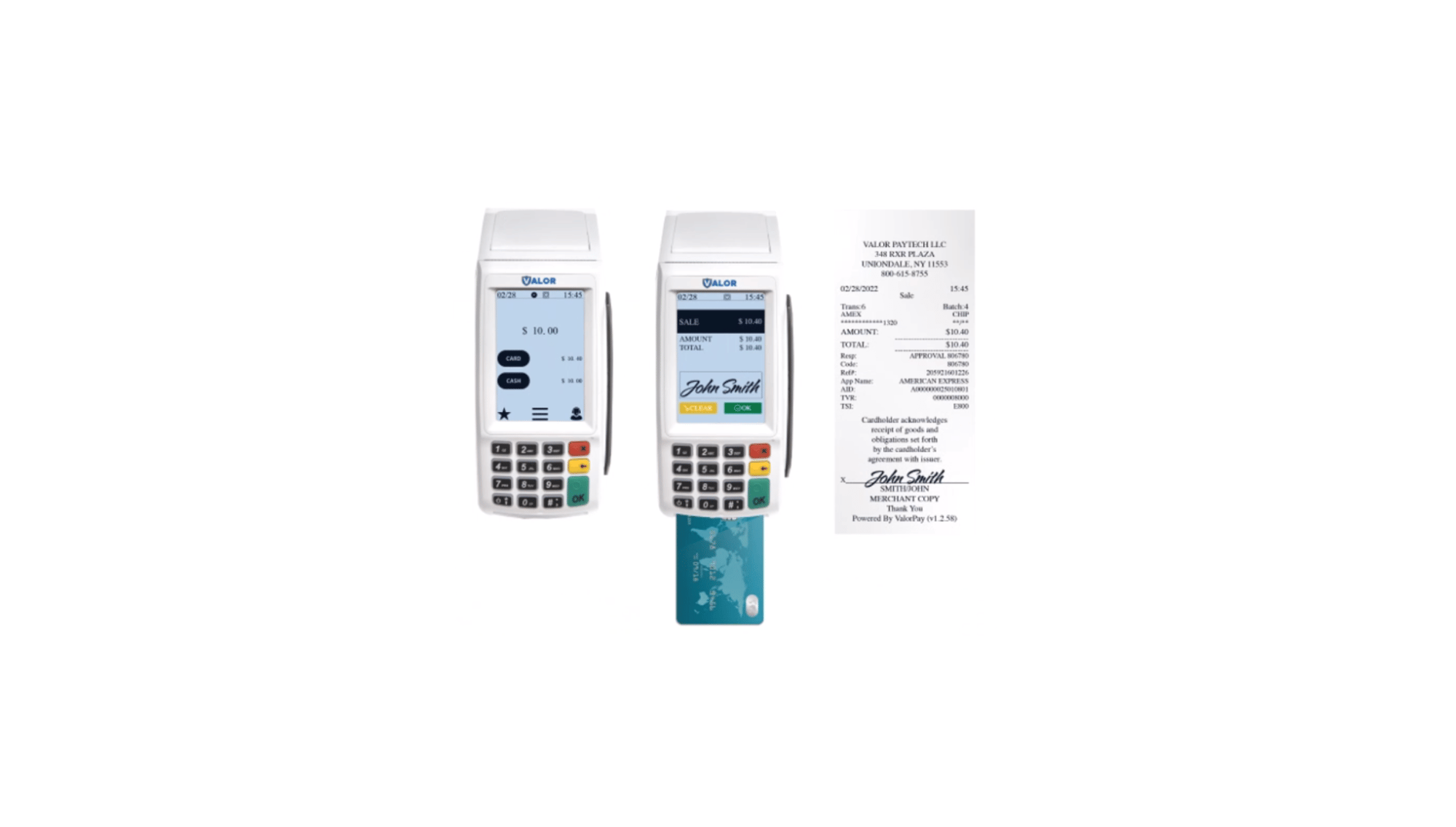

Receipts must clearly display the following line items in order: Subtotal, Surcharge, and Total, all shown above the signature line.

-

Proper signage must be posted at the entrance of your business, notifying customers that a 3% fee will be added to credit card purchases.

Staying compliant ensures transparency and protects your business from fines or penalties

What is Cash Discounting?

Also known as Dual Pricing, Cash Discounting is a program governed by the Durbin Amendment that allows you to offer a lower price to customers who pay with cash. To remain compliant, you must display both cash and credit card pricing, giving customers a clear choice at the point of sale.

For online transactions, ACH payments are an excellent "cash" alternative.

Cash Discounting is legal in all 50 states and applies to all card types. You can set any discount amount, though most businesses offer between 4% and 6%.

To ensure compliance:

-

You must post signage at the entrance of your business informing customers that both cash and credit pricing are available.

-

Receipts must show only the final purchase price—no line-item fees or surcharges should be listed.

Cash Discounting helps you offset processing costs while keeping pricing transparent and giving customers the power to choose.

What happens if I am not compliant?

Compliance rules around surcharge and cash discount programs are dynamic and typically updated every six months. Even small details—like the wording on your signage or the format of your receipt—can trigger a violation.

In most cases, Visa becomes aware of non-compliance within 90 days to 12 months, often because a customer contacts their card issuer with questions about a fee. This can prompt an investigation, including the use of a secret shopper to inspect your signage, pricing, and how the fees are presented.

Using alternative terms like "Administration Fee" is not a valid workaround and may lead to penalties.

If violations are found, you'll usually receive a notice and be given 30 days to correct the issue and bring your business into compliance.

That’s where we come in. While you focus on running your business, we actively monitor your program to ensure it stays compliant with the latest rules and updates—giving you peace of mind and protection from costly mistakes.

Using alternative titles like "Administration Fee" is not a work around.

They generally notify you of violatins and give you 30 days to make corrections to become compliant.

This is where we come in, you can manage your business and rest assured that we are keeping an eye on. your program to make sure you are. up to date with any changes.