How does Square and Stripe compare to traditional processors?

Speak with a real, live person

Traditional Processors have a local office to support you.

Pricing?

Did you click on the "terms and conditions" button without reading it?

Hardware

Any hardware options you have, a traditional processor can provide.

Online and Invoicing

Any feature for online payments, invoicing and reports are also available from a traditional provider.

Frozen Funds???

If you’ve ever had a payment frozen by Square, Stripe, or PayPal, you know how frustrating it can be—especially when there’s no real person to talk to. One minute you’re running your business smoothly, and the next, your deposits are held with no clear explanation, no timeline for release, and no one to call who can actually help. You’re left in the dark, your cash flow is frozen, and your business takes the hit—all because of vague automated systems and post-transaction red flags.

That’s why we do things differently. We use pre-underwriting—which means we review and approve your business before you start processing, so there are no surprises later. Square, Stripe, and PayPal rely on post-underwriting, analyzing your risk after you've already accepted payments. That’s when the trouble starts. With our approach, you get transparency, real people, and reliable deposits—because you deserve to get paid without the drama.

Customer Suppport

Just like it sounds, with a traditional provider, you can speak with a real person and have a local dedicated representative that can help you in-person.

How frustrated would you get if your deposits didn't show up, and you are waiting for a response to a message you sent two days ago?

With a dedicated account rep, you can contact them and they can make a call, pull some strings with their higher level contacts to expedite your issue or come to see you in person to assist.

Pricing

Imagine going into a new grocery store and to keep things simple, they have one price for every item. You are getting a deal on the high end stuff, but you are over paying for the low end stuff, right?

That is how Square and Stripe flat rate pricing works. There are over 600 different credit card rates. If that pricing structure doesn't work for buying groceries why would it work for all the money you spend to process cards and accept payments?

Now, imagine hidden deep in the pages of the terms and conditions that no one reads, they have extra fees above their advertised fees that you were no aware of.

AND, if you want next day deposits, something you get for FREE from a traditional provider, you have to pay an additional 1.75%!!

Square customers pay over 6% on average based on analysis we have done. Some are paying over 10%. Traditional customers pay an average of 2.15%. If you are a start up, Square is a good place to start. As you grow, your processing needs to grow with you.

Hardware

Traditional providers can provide any type of hardware, custom for your business, and with more options than Square.

If you use the basic Square on your phone, we have that. With ours the hardware is free, there are no monthly fees and no processing fees for accounts under $10,000 a month. Just a $10 a month statement fee.

If you use a sophisticated POS for your restaurant. We can choose from over a dozen POS systems to find the best fit for your business and a real person will assist you in setting up and installing your system.

Every industry has a custom system that will improve your efficiency and customer's buying experience; golf, restaurant, medical, veterinary, auto repair, contracting, retail, dry cleaning, etc.

Online sales

A traditional provider has multiple options to integrate into web sites. Some basics and some more sophisticated. All designed to maximize check out and create a better buying experience.

Integrating into a billing software like Quickbooks? There are several options to lower costs, speed up payments and lower costs.

Gateways can be as sophisticated as to where a each customer has their own secure portal and as basic to where you use a QR code for payments in the field.

Dedicated customer representatives assist you with the set up so you do not have to go it alone.

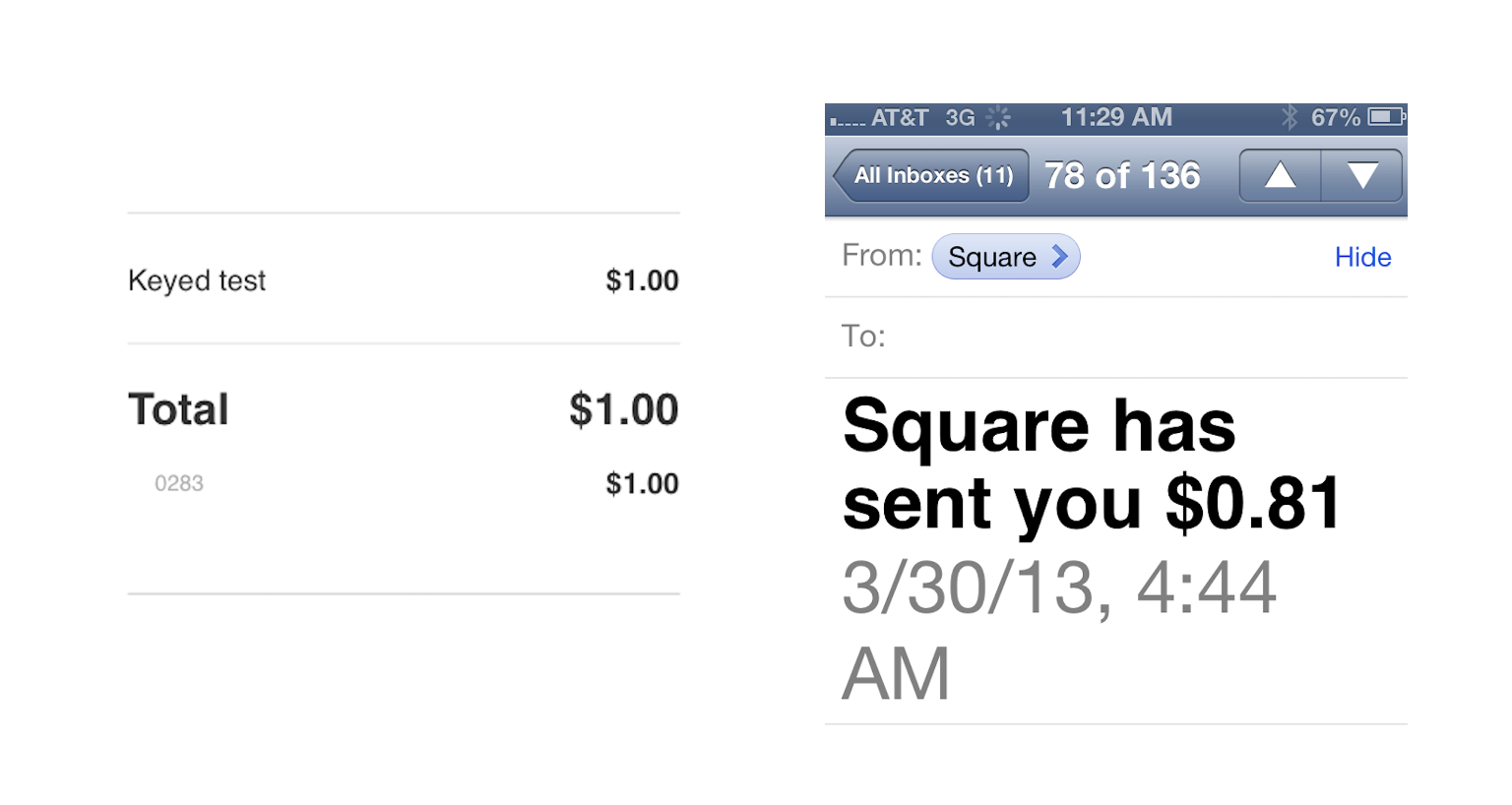

How do you know what you are paying?

Square has a way of depositing your funds that hides the fees you are paying. To find out, you have to do some detective work. When you get your deposit confirmation email, deduct the deposit from the sales. Those are your fees. Now, divide your fees by your sales and you will get a number like .00926. That converts to 9.26%